🎯 What Are the Most Effective Technical Analysis Strategies for Options Trading?

If you’re an options trader, you probably know that timing is everything. Unlike stocks, options have limited lifespans—so entering and exiting at the right moment is crucial. That’s where technical analysis becomes your best tool. In this article, you’ll explore the most effective technical analysis strategies for options trading, learn how professionals apply them, and get a complete step-by-step guide that you can start using—even as a beginner.

From breakout plays to momentum indicators, this guide provides a comprehensive and actionable roadmap to level up your options trading game.

📘 What is Technical Analysis in Options Trading?

Technical analysis involves studying historical price charts, indicators, and patterns to forecast future price movement. For options traders, it’s particularly valuable because:

- You need to predict short-term moves (due to expiration)

- Volatility impacts pricing

- Entry timing is critical

👤 Who Should Use These Strategies?

| Trader Type | Why Technical Strategies Help |

| Beginners | Structure trades with better timing and risk control |

| Intraday Traders | Catch quick moves for option scalping |

| Swing Traders | Hold positions 2–5 days based on strong setups |

| Option Sellers | Use TA to time safe entry for selling calls/puts |

Table of Contents

🧠 Why Technical Analysis Matters More in Options

Unlike stock trading, you’re not just betting on direction but also how fast and how far price moves. Technical analysis helps you:

- Enter at momentum shifts

- Avoid decaying time value

- Ride breakouts with volume

- Protect capital with stop-loss zones

🛠️ Step-by-Step: How to Use Technical Analysis in Options Trading

✅ Step 1: Choose Liquid Stocks or Index Options

Stick with high-volume tickers like:

- Nifty/Bank Nifty

- Reliance, TCS, Infosys

- HDFC Bank

Use NSE Option Chain to find active contracts.

✅ Step 2: Select Right Timeframe

For intraday: Use 5-min or 15-min charts

For swing: Use 1-hour or daily charts

✅ Step 3: Apply Key Indicators and Patterns

Here are some of the most effective technical strategies used in options trading:

🔑 Top 6 Technical Analysis Strategies for Options Trading

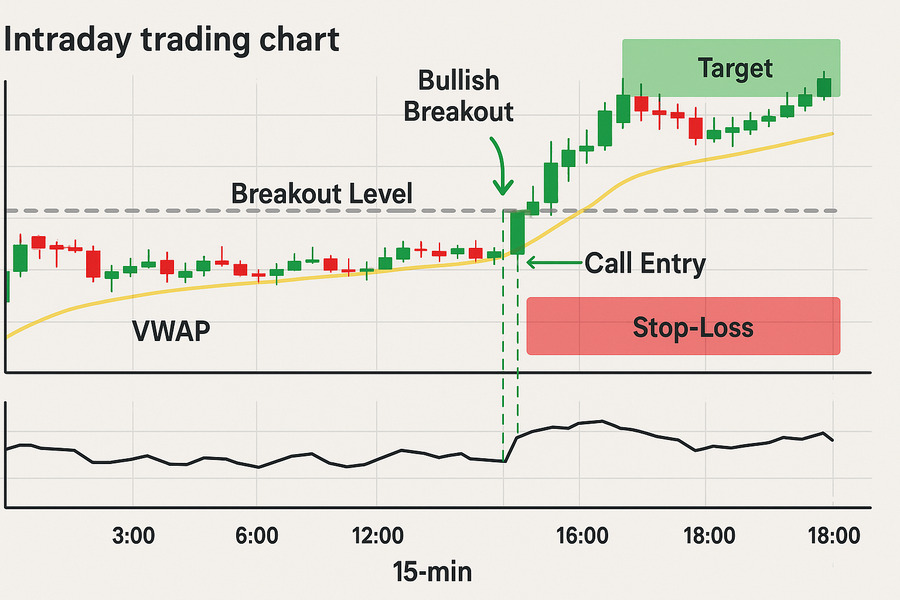

📈 1. Breakout Strategy with Volume Confirmation

How it works:

- Identify support/resistance levels

- Wait for breakout candle with high volume

- Enter Call on breakout or Put on breakdown

Example: Nifty breaks 23,500 resistance with volume spike → Buy 23,600 CE

Best for: Intraday or 1-day swing trades

🔁 2. Moving Average Crossover (EMA Strategy)

How it works:

- Use 9 EMA and 21 EMA

- Buy Call when 9 EMA crosses above 21 EMA

- Buy Put when 9 EMA crosses below 21 EMA

Combine with RSI or MACD to confirm direction.

⚠️ 3. RSI + Divergence Strategy

How it works:

- RSI < 30 = oversold → Watch for bounce

- RSI > 70 = overbought → Look for reversal

- Use divergence to spot early turns

Example: RSI shows bullish divergence while price makes lower low = Call option opportunity

📉 4. MACD Crossover for Trend Reversal

How it works:

Use for directional bets (CE or PE)

MACD line crosses signal line = entry trigger

Works well with Bank Nifty and trending stocks.

🔁 5. Support & Resistance Flip Strategy

How it works:

- Old resistance becomes new support (and vice versa)

- Look for bounce or rejection to enter option trade

Example: ₹2000 was resistance, now support → CE on bounce

🔃 6. VWAP Bounce Strategy (Intraday)

How it works:

Buy Put if breakdown below VWAP

If price bounces above VWAP with volume, trend is strong

Buy Call above VWAP

📊 Table: Strategy vs. Use Case

| Strategy Name | Best Timeframe | Option Type | Ideal Market Condition |

| Breakout with Volume | 15-min | CE/PE | Trending |

| EMA Crossover | 5–15 min | CE/PE | Fast momentum changes |

| RSI Divergence | 1-hr / Daily | CE/PE | Reversal scenarios |

| MACD Reversal | 1-hr | CE/PE | Trend changes |

| VWAP Bounce | Intraday | CE/PE | Volatile sessions |

| S&R Flip | All timeframes | CE/PE | Range breakout/back test zones |

⚖️ Pros and Cons of Technical Strategies in Options

| Pros | Cons |

| Precise entry/exit timing | May fail in news-driven markets |

| Helps avoid low-quality trades | False breakouts possible without volume confirmation |

| Combines well with option Greeks | Requires chart-watching and discipline |

| Easy to learn with practice | Complex if too many indicators are used |

💡 Bonus Tips for Better Results

- Always check Option Chain OI levels with your technical setup

- Stick to 1–2 setups and master them

- Avoid low-volume options, even if chart looks good

- Use alerts on TradingView to avoid staring at screens

- Avoid buying options with less than 2 days to expiry unless scalping

✅ Conclusion: Smart Technical Strategies Make Smart Option Traders

To succeed in options trading, you need to act fast but think smart. The best technical analysis strategies are the ones that help you cut through the noise, spot high-probability setups, and manage your risk with precision. Whether you’re trading breakouts, reversals, or trends, these tools—when used with discipline—can give you a real edge in today’s fast-moving options market.

🎯 Practice, backtest, and simplify. That’s the real secret of professional option traders.

🙋 Frequently Asked Questions (FAQs)

❓ Can technical analysis work for options trading?

Yes. It’s essential for timing entries/exits, especially in short-duration trades.

❓ Which is better: fundamentals or technicals in options?

For short-term trades, technicals are better. Fundamentals are more useful for long-term options strategies.

❓ Is RSI alone enough for option trading?

No. Use it with support/resistance or volume confirmation for better results.

❓ What’s the safest strategy for beginners?

Start with breakout + volume confirmation or VWAP bounce. Keep trades simple and avoid overtrading.

❓ Should I use Greeks with technical analysis?

Yes. Combine technical setups with Greeks like Delta and Theta for better-informed decisions.

Why Support and Resistance Important-A Safe Trading Decisions (2025 Guide)