🤖 Is Technical Analysis Still Relevant in an Algorithmic Trading Era?

In today’s world where high-speed computers and complex algorithms dominate financial markets, you may wonder—is technical analysis still relevant, or is it outdated? The answer isn’t black or white. Technical analysis (TA) continues to be useful, but it needs to adapt to this fast-changing algorithmic environment. In this article, you’ll explore how technical analysis fits in today’s algo trading era, who uses it, the pros and cons, and how you can still benefit from it effectively—even as a retail trader.

This guide is written to simplify a complex topic, help you think critically, and make smarter trading decisions with clear examples, charts, and real-life context.

Table of Contents

📘 What Is Technical Analysis, really?

Technical analysis is a trading method that studies price, volume, and chart patterns to forecast future price movements. It uses indicators like RSI, MACD, moving averages, support/resistance, and candlestick patterns.

But algorithmic trading—often called algo trading or quant trading—uses computer programs to place orders based on predefined conditions, many of which are technical in nature.

So, the real question becomes: Can humans still rely on TA when machines trade faster and more efficiently?

👤 Who Uses Technical Analysis Today?

| User Type | Why They Use TA |

| Retail Traders | Identify patterns for short-term opportunities |

| Swing Traders | Time entries/exits with indicators and setups |

| Professional Discretionary Traders | Combine TA with market experience |

| Even Algorithms! | Many algos are programmed based on technical signals |

🔍 How Is Technical Analysis Still Relevant?

Despite the speed and data crunching power of algos, technical analysis still holds its ground in these ways:

- Human Behavior Doesn’t Change

Charts reflect human emotions like greed and fear, which cause recurring patterns. - Algos Use TA Rules Too

Many algorithmic systems follow classic technical rules—moving average crossovers, breakout signals, RSI thresholds. - Short-Term Traders Still Need It

Day traders, scalpers, and options traders use TA every day to time entries and exits. - TA Adapts Easily

You can tweak technical strategies to factor in real-time volatility, liquidity, or market shifts.

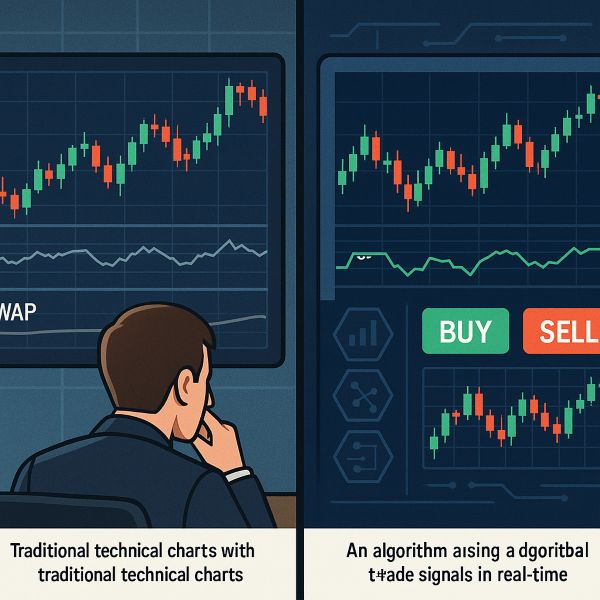

🧠 Real-Life Example: How Algos and TA Coexist

Imagine a large fund running a VWAP-based algorithm. It splits a large buy order into smaller trades based on volume throughout the day.

At the same time, you—an intraday trader—might see the VWAP bounce pattern and enter a trade based on it.

So while you and the algorithm operate differently, you’re both relying on the same core technical levels. That’s how TA stays relevant.

🛠️ Step-by-Step: How to Use Technical Analysis Effectively in an Algo-Driven Market

✅ Step 1: Focus on High-Probability Patterns

Use time-tested setups like:

- Flag patterns

- Double bottoms/tops

- Breakouts with volume

- RSI divergence

✅ Step 2: Combine TA with Market Context

Use TA alongside:

- News events

- Volatility indicators

- Sentiment data (FII/DII flows)

✅ Step 3: Avoid Overused Signals

Algos may front-run crowded strategies. So avoid:

- Obvious moving average crossovers without volume

- Overused RSI thresholds without confluence

✅ Step 4: Use Volume and VWAP Smartly

Volume + price = powerful. VWAP acts as a support/resistance line that even institutional traders’ respect.

✅ Step 5: Backtest and Forward Test

Before live trading:

- Backtest your TA strategy on historical data

- Paper trade it in real markets for a month

📊 Table: TA vs. Algorithmic Trading – What’s Different?

| Factor | Technical Analysis | Algorithmic Trading |

| User | Human trader | Computer program |

| Decision Speed | Manual, slower | Instantaneous |

| Strategy Flexibility | High (can adapt to emotion/news) | Limited to code |

| Chart Dependency | High | Often uses charts and math formulas |

| Common Use Cases | Intraday, swing trading | Arbitrage, HFT, large orders |

⚖️ Pros and Cons of Technical Analysis in the Algo Era

| Pros | Cons |

| Still reflects real price action | Can be manipulated by high-frequency trading |

| Easy to learn and apply | Slower than algorithmic execution |

| Algos are often based on TA rules | May lag in extremely volatile or illiquid markets |

| Can combine with other forms (sentiment, fundamentals) | Requires constant updating and adjustment |

💡 Tips for Retail Traders Like You

- Keep your strategy simple and well-tested

- Avoid low-liquidity stocks—algos thrive there

- Use volume, price action, and VWAP as primary signals

- Don’t over-rely on indicators—combine them with chart structure

- Trade at times when market is more liquid (opening hour, pre-close)

✅ Conclusion: Yes, Technical Analysis Is Still Relevant—But Smarter Now

In a world dominated by machines, you may feel outmatched. But remember—algorithms still follow rules, and many of those rules are based on technical analysis. You don’t have to trade like a robot to succeed. You just need to combine logic, discipline, and adaptability. If you treat TA as a tool (not a magic wand), it will continue to serve you—even in 2025 and beyond.

🎯 The charts are still the battlefield. It’s how you read them that gives you an edge.

🙋 Frequently Asked Questions (FAQs)

❓ Is technical analysis outdated in the age of algorithms?

Not at all. In fact, many algorithms are programmed using technical analysis rules.

❓ Can I beat algos using TA?

You don’t need to beat them. You just need to adapt by trading smarter and avoiding low-liquidity traps.

❓ Should I learn algorithmic trading instead?

If you’re interested in coding, yes. Otherwise, TA is simpler and still effective for short-term trades.

❓ Is there a TA strategy that algos don’t use?

Algos can use almost every strategy. But combining TA with human context—like news or psychology—still gives you a unique edge.

How to Back test Technical Analysis Strategies for Stocks Effectively – Full Beginner’s Guidehttps://technicalanalysisintrading.com/wp-admin/post.php?post=177&action=edit

Top 6 Effective Technical Analysis Strategies for Options Trading [Complete Guide]https://technicalanalysisintrading.com/wp-admin/post.php?post=179&action=edit